1. In 2004, representatives of the five largest investment banks, lead by Henry Paulson, the then CEO of Goldman Sachs, pressured/lobbied the SEC to neuter the net capital rule. This rule set limits on the amount of leverage that brokerages of investment banks could incur. The SEC caved and lifted the restriction on investment banks, who proceeded to acquire a plethora of debt. In 2006, Paulson was appointed Secretary of Treasury and held the position through the 2008 meltdown and resulting bailouts. Thus, the man most responsible for the September 2008 collapse was allowed to use government funds to transfer the consequences of his own wrecklessness to the taxpayers.

2. On 3/13/2009, Discover Financial Services sold $1,224,558,000 worth of 5% preferred stock to the Treasury, under the TARP program. (Yes, I know that TARP is so 2008.) Of course, DFS can follow the Citigroup precedent of gaming the program by converting the preferred shares to common at a premium, which removes the 5% return for taxpayers, dilutes the common share price, and eliminates TARP's principal repayment requirements.

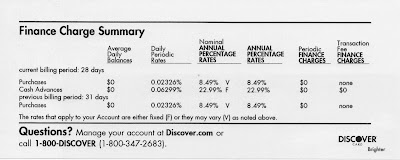

As you can see below, if I want to borrow some of "my" money from Discover, I have to pay an APR of 8.49%.

Per a recently received amendment to my account terms, a late payment constitutes a default event which triggers a higher rate on the balance.

Per a recently received amendment to my account terms, a late payment constitutes a default event which triggers a higher rate on the balance. Thus, Discover Financial Services gets to borrow my tax dollars at a nominal rate of 5% (likely less) and lend it back to me at 8.49%. If I miss a payment, due to hardship caused by the current debt-orgy induced Depression, I then get charged up to 29.99%, because I couldn't return my tax dollars to Discover quickly enough. Call me a "wild-eyed Populist," but this is, yet, another absurd example of how the government has been entirely captured by corporate interests bringing me to my next point.

Thus, Discover Financial Services gets to borrow my tax dollars at a nominal rate of 5% (likely less) and lend it back to me at 8.49%. If I miss a payment, due to hardship caused by the current debt-orgy induced Depression, I then get charged up to 29.99%, because I couldn't return my tax dollars to Discover quickly enough. Call me a "wild-eyed Populist," but this is, yet, another absurd example of how the government has been entirely captured by corporate interests bringing me to my next point.3. The recent 20% rally in equity prices is a Sucker's Rally, but not in the traditional sense. Since the announcement of the Treasury's public/private plan for screwing the taxpayer for the benefit of the banks, part IV, the DJIA has risen about 6%. This is despite continued high unemployment and China's central bank calling for a new reserve currency. In fact, all week long the gleeful media was foisting claims of a definitive bottom on the public. There is nothing economically positive about the Geithner-Summer plan, since it increases public debt over the long term and will further hamstring the taxpaying consumer whose spending has carried the economy for the last 8 years. Wall Street knows this, so what is the cause for celebration? The fact that we are 6 months into this disaster and the public has hardly acknowledged the blatantly corrupt wealth transfer mechanisms that Treasury has implemented on behalf of Wall Street. To add insult to injury, the Suckers are fueling this dead cat bounce, like all of the others, with their retirement funds and will be holding the bag, yet again, when the smart money cashes out.

Perhaps, I'm being too harsh on the general public, since these tumultuous times have caused folks to focus on more pressing matters. After all, Simon's incessant flirting with Paula is beginning to irritate Ryan, which can't be a sustainable situation.