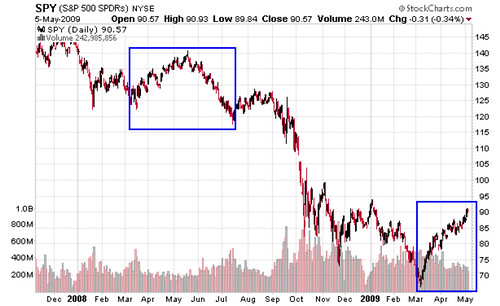

Prediction I: This rally is an extended sucker's rally. This isn't much of a stretch considering that 70% of the GDP is consumer based and somewhere between 10-15% of these consumers are now jobless. However, I am reminded of a time when I was all in on fairly out of the money puts. At the time, the government and the MSM were lying about the state of the economy, despite obvious evidence to the contrary. The experts called the bottom and proclaimed that up was the only direction remaining. I spent weeks mentally willing the destruction of the stock market, to no avail. For a month, I questioned whether I'd arrived at a very wrong and expensive conclusion about the economy's direction. That month was March of 2008:

Thus, Spring of 2009 seems hauntingly familiar, except I hold no derivative positions. Sure enough, it charts similarly, as well. Increasing pricing on decreasing volume seems to be the portent of doom. (3/08-7/08, Thanksgiving 08-Feb 09). I am attempting to become a reformed speculator, but synthetically shorting crap like WYN @ 10 is so very, very tempting (-WYN HB, +WYN HV (protection), +WYN TB). We'll see if discipline prevails.

Thus, Spring of 2009 seems hauntingly familiar, except I hold no derivative positions. Sure enough, it charts similarly, as well. Increasing pricing on decreasing volume seems to be the portent of doom. (3/08-7/08, Thanksgiving 08-Feb 09). I am attempting to become a reformed speculator, but synthetically shorting crap like WYN @ 10 is so very, very tempting (-WYN HB, +WYN HV (protection), +WYN TB). We'll see if discipline prevails.Prediction II: 401(k)/IRA redemptions and loans will be restricted. Over 5M Americans are unemployed and that's likely a conservative estimate. Moreover, many of the unemployed/underemployed have been so for months now. As the personal savings rate actually went negative during the bubble and the collective home equity piggy bank has been smashed, defined contribution funds are increasingly likely to be drained. Moreover, people are beginning to wise up to the fact that the 401(k) may well have been the greatest scam ever perpetuated by Wall Street, next to Donald Trump's hair. Thus, there has been a steady outflow of cash from equity mutual funds over the last year. If you compare the market capitalization of the NYSE to defined contribution plan/IRA equity assets, you'll discover the Evil Whose Name Can Never Be Spoken: Much of Wall Street is Main Street. While this topic could easily fill another 10 posts, if not an entire blog, let it suffice to say that DC plan redemptions en masse would cripple the stock market. Notice how Obama's campaign promise to ease penalties on 401(k) hardship redemptions has never been revisited. As the stock market goes, so does Wall Street, so this will not be allowed to happen

Prediction III: Municipalities will default in record numbers and won't get bailouts resembling what Wall Street received. Recently, I've been looking at the budgets of various local governments across the country. During the credit bubble, many ran deficits, not unlike their citizens. Unfortunately, municipalities generate revenue primarily through real estate tax, sales tax, and, less often, income tax, which are all falling at a significant rate. I expect that they'll attempt to issue more bonds, but at some point credit rating deterioration will induce unservicable rates. I don't expect significant federal assistance either, due to Wall Street's complete ownership of Congress and the Treasury. Instead, bankrupt cities will have privatization rammed down their throats, because little is more profitable than a monopoly on products with inelastic demand, like water and policing.

Prediction IV: Free markets will become even more farcical with consolidation. I don't think there is a company in existence that is interested in truly free trade. In practice, the phrase "free trade" has come to stand for using competition to decrease input costs, while attempting to reduce competitive forces affecting output prices. A developing nation's poverty will continue to be viewed as its greatest resource, to the detriment of American workers who insist on an "extravagant" standard of living. Wage and benefit claw backs will increase, while price fixing becomes even more blatant, as competing companies consolidate. In the last decade, we've seen little along the lines of anti-trust legislation or enforcement and I expect this to worsen. Within 5 years, I can envision the same style of collusion, demonstrated by the petroleum industry under Bush, to be adopted by producers of goods with low elasticity, like food, medicine, and energy.

Prediction V: This blog will not get any funnier. Truly humorous blogs are a rarity, while commonality is a staple here. Thus, never doubt my grave sincerity when I make proclamations like; the only asset class that is guaranteed to continually appreciate is Golden Girls memorabilia, which constitutes the basis for its use as a global currency standard. Really, I think I may have been mistaken for someone else.

So there you have it. In a year, I, hopefully, can look back at this post and say, "What a moron. I need to trade my computer in for an Etch-A-Sketch." In the mean time, I'll be working on my Canadian residency visa and hoarding Bea Arthur posters by the gross.

The 'what's' of you forecast certainly seems reasonable to me. Timing is the hard part.

ReplyDeleteNo humor required...